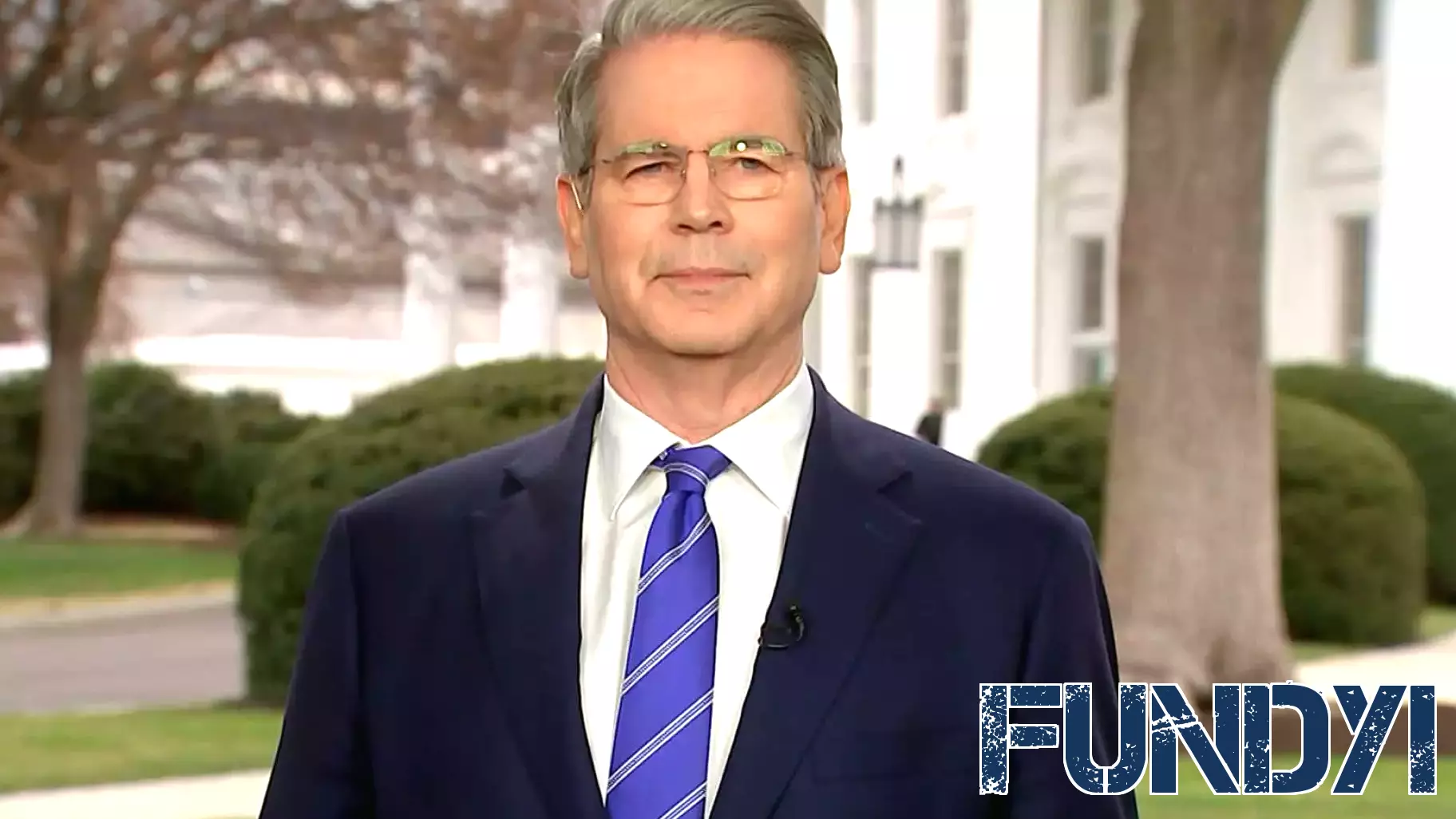

Bessent Assures Public of Economic Stability Amid Market Fluctuations

March 16, 2025 - 23:52

In a recent statement, Treasury Secretary Bessent expressed confidence that the current market pullbacks are merely temporary and not indicative of a looming financial crisis. He emphasized that the administration's pro-business policies, initiated under former President Trump, are designed to foster long-term economic growth. Bessent noted that these strategies aim to stimulate investment and create jobs, which he believes will ultimately strengthen the economy.

While acknowledging the volatility in the financial markets, Bessent reassured citizens that the government is actively monitoring the situation and implementing measures to mitigate risks. He described the current economic landscape as resilient, citing strong fundamentals that support a positive outlook.

Bessent's remarks come at a time when many are concerned about potential downturns in the economy. However, he remains optimistic, encouraging businesses and investors to focus on the long-term benefits of the administration's economic policies.

MORE NEWS

February 6, 2026 - 01:38

Lightspeed bets on transformation as stock slides on Q3 lossThe commerce software company Lightspeed finds itself navigating a period of significant transition as it reports a deepening net loss for its third fiscal quarter. The financial results, which...

February 5, 2026 - 05:32

Bitcoin Extends Selloff as Macro Pressures and Leverage UnwindThe cryptocurrency market is facing intensified selling pressure this week, with Bitcoin leading a broad decline. The premier digital asset has extended its recent losses, tumbling to multi-week...

February 4, 2026 - 23:00

Michael Burry issues bitcoin warning, AMD stock falls hardThe financial markets experienced significant volatility mid-week, marked by sharp moves in key technology stocks and a stark warning from a prominent investor. Chipmaker Advanced Micro Devices...

February 4, 2026 - 06:46

Grab Holdings Limited (GRAB): A Bull Case TheoryA compelling investment thesis is gaining traction among analysts, painting a bullish future for Grab Holdings Limited. The Southeast Asian superapp company, whose stock recently traded around...