Jackson Financial's Evolving Narrative: Analyst Upgrades and Buyback Impact

October 10, 2025 - 01:10

Jackson Financial has recently experienced a slight increase in its fair value price target, rising from $103 to $104.80. This adjustment follows updated outlooks from analysts who are optimistic about the company's revenue growth and the robust performance of its core business segments. The positive revisions reflect a growing confidence in Jackson Financial's ability to navigate the current market landscape effectively.

Investors are encouraged to monitor these changes closely, as they signify a shift in how the company is perceived within the financial sector. The ongoing buyback program further bolsters investor sentiment, as it not only demonstrates the company's commitment to returning value to shareholders but also signals management's belief in the company's future potential.

With these developments, Jackson Financial is positioning itself as a compelling option for investors looking to capitalize on its strengthening fundamentals and favorable market conditions. As the narrative continues to unfold, stakeholders should stay alert to new insights and opportunities that may arise.

MORE NEWS

February 23, 2026 - 13:56

Hong Kong's Financial Sector Sees Hiring Surge Amid IPO RevivalNew data reveals a significant uptick in employment within Hong Kong`s financial services industry, with an impressive 4,800 new roles added in the twelve months leading to September. This surge is...

February 22, 2026 - 19:01

Jefferson City finance and IT director to retire in springAfter a dedicated tenure overseeing the financial and technological operations of Missouri`s capital city, Finance and IT Director Shiela Pearre has announced her plans to retire this spring. Her...

February 22, 2026 - 02:54

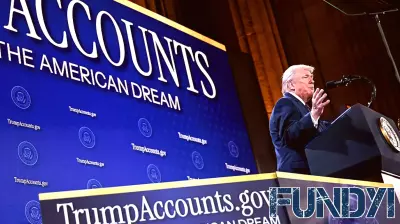

Trump accounts have 'more unanswered questions than answered,' expert says. What's still unknownFinancial experts are raising significant questions about the management and oversight of accounts established during the previous administration. While certain families saw direct benefits from...

February 21, 2026 - 03:21

Potentially some money missing:’ Baltimore nonprofit has 'sloppy’ finances, experts sayA Baltimore City nonprofit awarded a substantial $6 million state contract is facing scrutiny over significant financial management and transparency issues. Experts reviewing the organization`s...