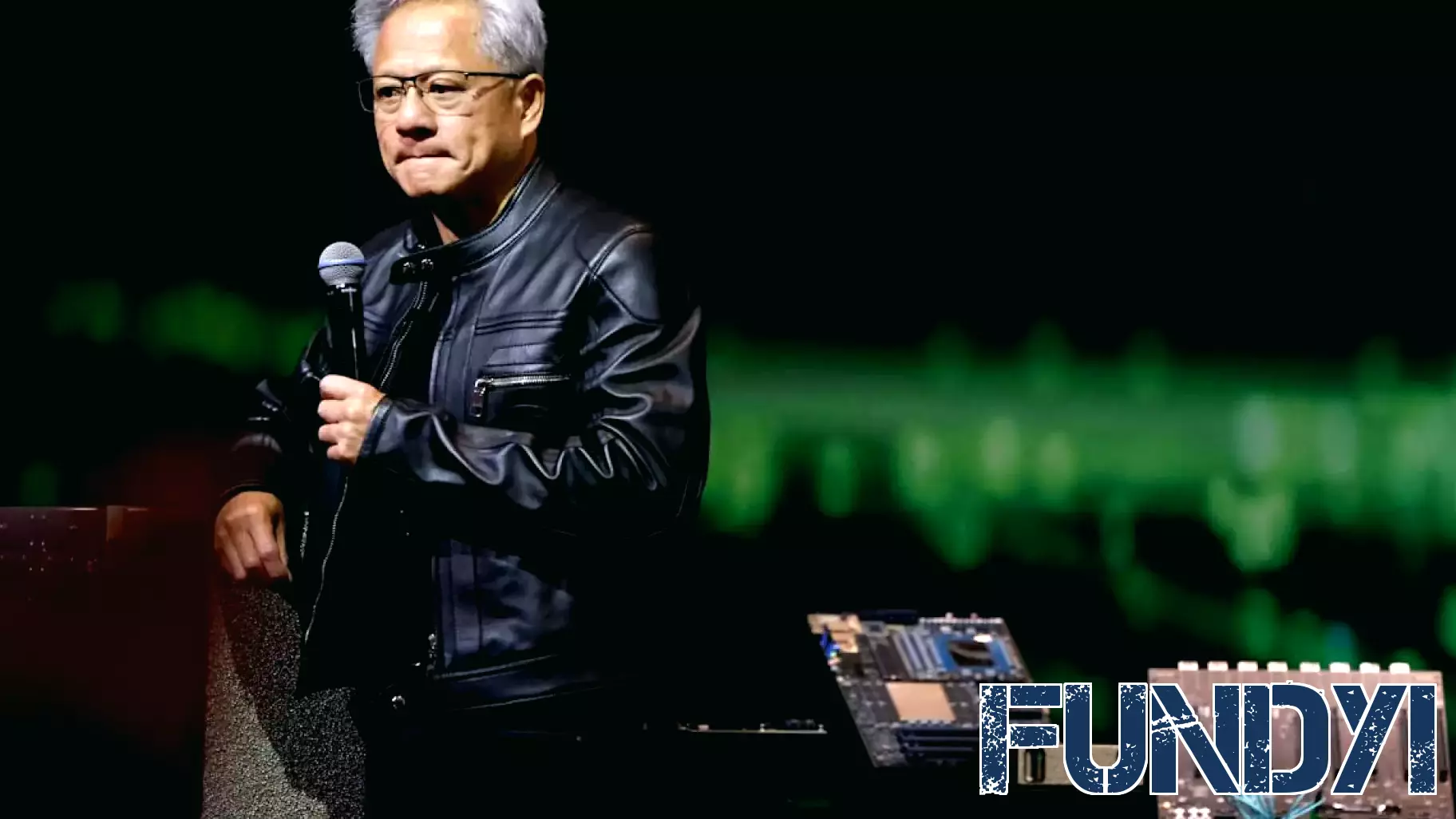

Nvidia's Revenue from China Expected to Exceed $6 Billion Amid Export Ban Concerns

May 27, 2025 - 20:29

China has emerged as a critical market for Nvidia, with projections indicating that the company's revenue from the region is set to surpass $6 billion in the first quarter. As the tech giant prepares for its upcoming earnings report, investors are keenly focused on the potential implications of the recent chip export ban imposed by the Trump administration.

This ban raises significant questions about the future of Nvidia's operations and sales in China, a market that has been a substantial driver of growth for the company. Analysts are eager to hear Nvidia's insights on how these restrictions may affect their supply chain and overall revenue.

The earnings report will likely provide crucial information that could shape investor sentiment and stock performance. As the tech landscape continues to evolve, Nvidia's ability to navigate these challenges will be closely scrutinized, making this earnings call a pivotal moment for the company's future in one of its most lucrative markets.

MORE NEWS

February 6, 2026 - 01:38

Lightspeed bets on transformation as stock slides on Q3 lossThe commerce software company Lightspeed finds itself navigating a period of significant transition as it reports a deepening net loss for its third fiscal quarter. The financial results, which...

February 5, 2026 - 05:32

Bitcoin Extends Selloff as Macro Pressures and Leverage UnwindThe cryptocurrency market is facing intensified selling pressure this week, with Bitcoin leading a broad decline. The premier digital asset has extended its recent losses, tumbling to multi-week...

February 4, 2026 - 23:00

Michael Burry issues bitcoin warning, AMD stock falls hardThe financial markets experienced significant volatility mid-week, marked by sharp moves in key technology stocks and a stark warning from a prominent investor. Chipmaker Advanced Micro Devices...

February 4, 2026 - 06:46

Grab Holdings Limited (GRAB): A Bull Case TheoryA compelling investment thesis is gaining traction among analysts, painting a bullish future for Grab Holdings Limited. The Southeast Asian superapp company, whose stock recently traded around...