Optimism in the Market Following Fed Official's Rate Cut Signal

November 25, 2025 - 01:13

In a surprising turn of events, investor sentiment in the stock market has taken a positive leap as a Federal Reserve official hinted at the possibility of a rate cut in December. This news has ignited hopes among traders and analysts, leading to a notable rally in major indices.

The Nasdaq and S&P 500 have both experienced significant gains, driven by strong performances from leading tech giants such as Nvidia, Tesla, and Google. These companies have shown resilience and growth potential, contributing to the overall bullish sentiment in the market. The tech sector, often viewed as a bellwether for market trends, has rallied as investors bet on continued innovation and demand in the technology space.

The prospect of lower interest rates is seen as a boon for economic growth, encouraging spending and investment. As the market reacts positively to this news, many are closely monitoring upcoming economic indicators and Fed communications, which could further influence market dynamics in the weeks to come.

MORE NEWS

February 23, 2026 - 13:56

Hong Kong's Financial Sector Sees Hiring Surge Amid IPO RevivalNew data reveals a significant uptick in employment within Hong Kong`s financial services industry, with an impressive 4,800 new roles added in the twelve months leading to September. This surge is...

February 22, 2026 - 19:01

Jefferson City finance and IT director to retire in springAfter a dedicated tenure overseeing the financial and technological operations of Missouri`s capital city, Finance and IT Director Shiela Pearre has announced her plans to retire this spring. Her...

February 22, 2026 - 02:54

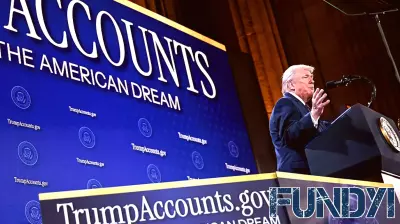

Trump accounts have 'more unanswered questions than answered,' expert says. What's still unknownFinancial experts are raising significant questions about the management and oversight of accounts established during the previous administration. While certain families saw direct benefits from...

February 21, 2026 - 03:21

Potentially some money missing:’ Baltimore nonprofit has 'sloppy’ finances, experts sayA Baltimore City nonprofit awarded a substantial $6 million state contract is facing scrutiny over significant financial management and transparency issues. Experts reviewing the organization`s...