Why this veteran capitalist is more bullish on robotaxis than humanoids

January 27, 2026 - 00:55

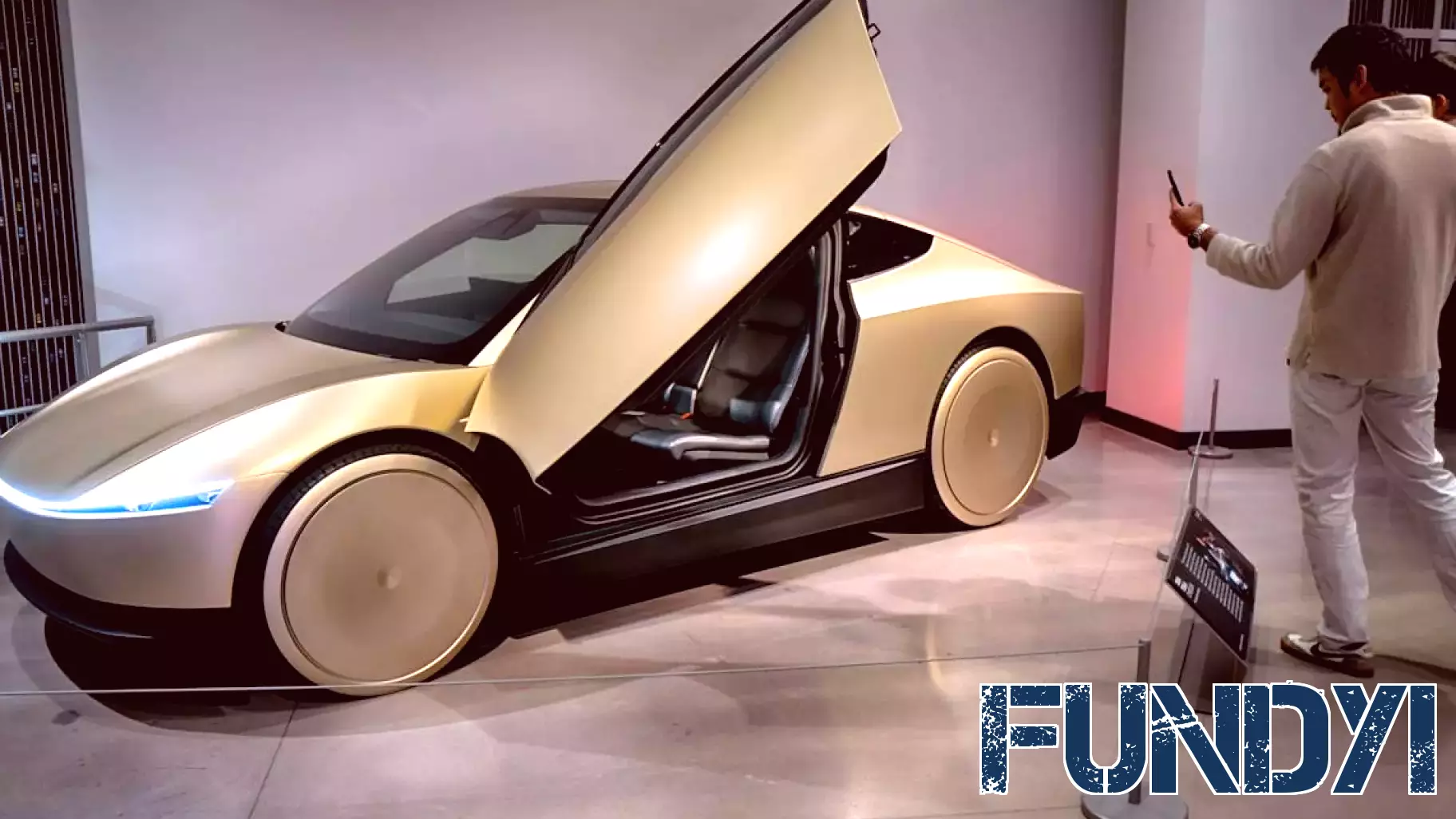

A seasoned voice in venture capital is casting a decisive vote in the emerging technology arena, expressing significantly stronger conviction in the future of autonomous ride-hailing services over humanoid robots. While both fields capture the public imagination, the analysis hinges on a clearer path to market and economic viability.

The argument centers on the defined environment and immediate utility of robotaxis. These vehicles operate within a structured domain—roads and highways—with a singular, valuable function: transportation. This focus allows for iterative improvement and scaling within an existing, multi-trillion dollar global market. The service model, akin to current ride-hailing, presents a familiar revenue stream that investors can readily quantify.

Humanoid robots, in contrast, face a steeper climb. Their envisioned general-purpose nature, aimed at navigating unpredictable human spaces and performing diverse tasks, represents a monumental technical challenge. The commercial path is also less clear, requiring development across multiple industries simultaneously without a single, dominant use-case to drive initial adoption.

The capitalist's stance underscores a fundamental investment principle: near-term bets are better placed on technologies solving specific, large-scale problems within a defined framework. The robotaxi race, despite its own hurdles, is seen as being several laps ahead on the track to commercialization and societal impact, making it the more bullish proposition for now.

MORE NEWS

January 26, 2026 - 04:40

What Catalysts Are Reframing The Story For Fulton Financial (FULT)?Fulton Financial Corporation finds itself under renewed scrutiny as financial analysts adjust their price targets for the stock. This reassessment stems from a combination of evolving economic...

January 25, 2026 - 08:01

Pursuing early retirement led this financial coach to marriage counseling—here's how he changed his strategyFinancial coach Andy Hill discovered that the relentless pursuit of early retirement could come at a steep personal cost. His singular focus on aggressive savings numbers, a common tactic in the...

January 24, 2026 - 23:05

AI productivity could become 2026 risk if gains lead to job lossesA leading economist has identified artificial intelligence as a pivotal, yet potentially risky, factor for the U.S. economy in 2026. While the rapid adoption of AI is expected to significantly...

January 24, 2026 - 04:41

Brian Ferdinand of EverForward Trading Selected for Forbes Finance Council Following Peer Review ProcessBrian Ferdinand, Portfolio Manager and Trader at EverForward Trading, has earned a prestigious invitation to join the Forbes Finance Council. This elite community is reserved for accomplished...